- Design industry shaping loyalty programs

- Integrate easily and go live quicker

- Deliver hyper-personalized consumer experiences

Blue Rewards from Al Futtaim Group Shares Loyalty Success Stories and Evolution. Watch Podcast >

Capillary Triumphs with 4 Prestigious Wins at the 2025 International Loyalty Awards! Read more >

64% of the world’s oil reserves come from the Middle Eastern region. Ironically, when it comes to forecourt businesses, each GCC country has taken a different pace. While the UAE and Qatar are on par with the US and European fuel stations, Saudi Arabia is still catching up. This contrast is surprising given Saudi Arabia’s massive reserves of over 260 billion barrels—the highest among GCC nations.

Part of this delay lies in shifting consumer trends within the Kingdom. With increasing female drivers and large players like ADNOC and Saudi Aramco expanding their reach, momentum is building. Meanwhile, the UAE and Qatar have raced ahead, driven by their population’s strong affinity for automobiles and a higher appetite for digital experiences.

But petrol stations are evolving into more than just places to refuel. They’re transforming into multi-purpose lifestyle hubs—offering retail, personal services, delivery pickup points, EV charging, and more. At the heart of this shift? Loyalty programs. These programs are now central to shaping the modern fuel experience, helping brands differentiate in a rapidly diversifying market.

Let’s explore the loyalty trends fuel retailers in the region should prioritize:

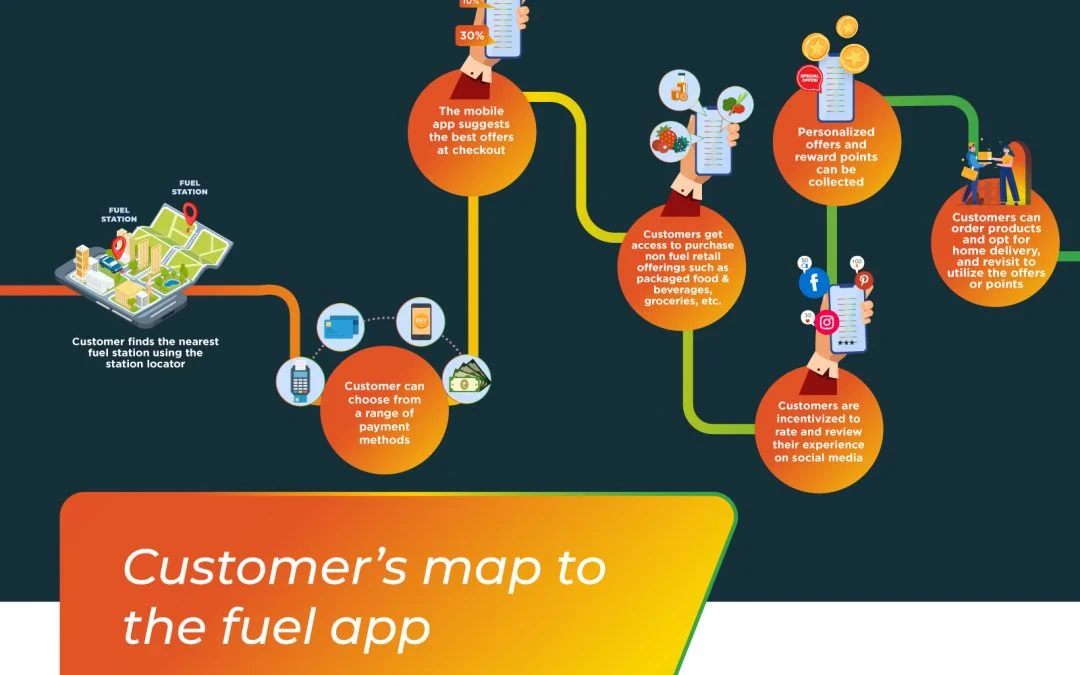

Today, mobile apps are no longer a value-add—they’re a necessity. Fuel retailers can digitize the entire journey: from locating the nearest station via geolocator to using digital wallets, accessing real-time promotions, managing subscriptions for delivery services, and earning loyalty points.

As of 2025, there are over 200 million smartphone users in the Middle East, with mobile payment adoption reaching record highs, especially in the UAE and Saudi Arabia. A robust app with loyalty at its core gives brands a powerful way to build relationships and drive repeat visits.

The push toward electric vehicles has accelerated significantly across the GCC. Saudi Arabia has committed to manufacturing over 500,000 EVs by 2030, while the UAE has already installed over 1,000 public charging stations.

What once seemed counterintuitive in oil-rich nations is now a national strategy. Forward-looking fuel retailers are not just setting up EV infrastructure but also using loyalty to reward sustainable behaviors, like using EV chargers, recycling at forecourts, or opting for paperless receipts.

In today’s climate-conscious world, brands that showcase transparency and take visible sustainability actions (via apps, loyalty dashboards, and physical infrastructure) are more likely to win trust and long-term loyalty.

Customers today see fuel stations as convenient one-stop destinations, not just a pit stop. In fact, in a 2024 Bain report, 68% of fuel station customers in the Middle East said they purchase food, drinks, or services in addition to fuel.

From QSR tie-ups and mini marts to pharmacy kiosks and even wellness zones, non-fuel offerings are becoming key drivers of footfall. Loyalty programs can amplify this trend by offering cross-category benefits—for example, offering discounts on food purchases based on fuel volume, or earning reward points that can be redeemed across fuel, F&B, and car services.

As EV adoption grows and dwell time increases, ancillary services like car detailing, pick-up/drop logistics, and last-mile parcel services become high-value loyalty levers.

What began as a COVID-era innovation has now become a standard offering in the region. Brands like CAFU in the UAE and others in Saudi Arabia now offer scheduled or on-demand fuel delivery, bundled with app-based loyalty perks.

Consumers have grown accustomed to convenience-first lifestyles. Fuel delivery apps now go beyond emergencies—they offer subscription packages, membership tiers, and even combo deals on fuel, groceries, and services. Loyalty programs integrated within these apps can track usage, reward frequency, and gamify refueling behavior.

Middle Eastern consumers are increasingly open to value-driven data sharing. In exchange for personalized offers, they’re happy to share location, purchase patterns, or preferences.

By 2025, over 75% of loyalty programs in the region will leverage AI-driven personalization (source: McKinsey Middle East Loyalty Trends Report, 2024). With robust CDPs, fuel retailers can now build dynamic loyalty journeys—offering hyper-personalized rewards based on time of visit, product preference, frequency, and even behavior across other retail formats.

Push notifications, personalized discount prompts, and AI-curated bundles based on lifestyle can drive both retention and basket size.

The future of fuel retail is undeniably tied to the future of mobility, and in the GCC, that means EVs, sustainability, and digitization. By 2040, sustainable mobility is expected to unlock a $400 billion opportunity across the region. While private vehicle ownership remains high, the shift toward shared mobility and EVs is inevitable.

For fuel retailers, this means evolving loyalty from a transactional model to an ecosystem engagement engine, rewarding not just refuels but a lifestyle. The forecourt of tomorrow won’t just offer fuel; it will offer value, experience, and relevance.

Want to future-proof your fuel loyalty strategy?

Get in touch with our experts to explore how your brand can stay ahead of consumer expectations—and become a preferred pit stop in your customers’ journey.

January 10, 2025 | 6 Min Read

Fuel loyalty programs are evolving fast. Discover the latest

November 29, 2021 | 4 Min Read

Globally, the evolution in the Fuel, Oil and Gas industry ha

November 12, 2021 | 4 Min Read

The challenging dynamics created by COVID-19, has destabiliz