For most of us, Covid-19 is the first time we have lived through a globally traumatic and emotion-inducing event, in real-time, with the whole world connected. From a brand’s perspective, Covid-19 has reminded us, rather dramatically, that emotions are a big part of our decision-making process and how fear, anxiety and panic can impact sales.

Based on our interactions with 400+ brands, Thought Leaders and Retail Experts, we’ve compiled some strategies focussed on enhancing engagement, maintaining top of mind recall and creating long-term emotional connect with your customers during these tough times.

Key Strategies to Build Emotional Connect

-

Lead with Empathy

One of the easiest ways to connect with your customers is to empathize with the challenges and struggles that they are undergoing due to the crisis. There has been a massive shift amongst consumers preferring socially conscious and sustainable brands in recent years and this is a good time to showcase your brand as socially responsible and empathic when the times are tough.

Campaign Ideas :

The core idea should be to replace sales-oriented marketing campaigns and promotions with human stories centred around your staff, your customers and the larger community. This positions the brand as someone who cares about what consumers truly value rather than what sells. And by creating content that evokes empathy, consumers are more likely to take action – sharing, responding, and even prompting change within their own communities.

- First and foremost, remind your customers that you are there for them in any which way you can be.

- Your customers are your community – let them know how you’re responding to the crisis, how you’re conducting business, and what health precautions you’re taking.

- Ask your customers how you can support them during this time, and let them know how they can support your brand as well.

- Share stories that reiterate your commitment towards your frontline staff like paying their salaries in advance or setting up an emergency fund through SMS and on social media. Most importantly, encourage your employees to comment and share these posts to ensure maximum reach.

- Send a community wellness mailer on what your brand is doing for the community – for instance, opening up warehouses for providing refuge during quarantine, increase health care or basic pay for employees who are unable to make it to work etc.

Example: Store Closure Communication by Reformation

Sustainable fashion brand, Reformation, sent out this email to its customers that addressed how they’re responding to the crisis along with a note at the end asking them what they should be talking and posting about. By being candidly vulnerable about not being sure as to what they should talk about, they have been able to create empathy for themselves with their consumers. This small detail shows that they care about their consumers and are open to ideas (in the process elevating them to collaborators rather than just end users).

-

Align your message with ongoing health & safety protocols

Brands can echo or amplify government and health organization guidelines by serving as PSA disseminators during this crisis. By rallying your customers around a larger and pertinent cause, your brand gains a dual advantage – you cultivate the team spirit and tribe-like mindset amongst your brand audience, and more importantly, you position the brand as sensitive to the realities of life; thereby making it more humane and relatable.

Campaign Ideas :

These campaigns are great for apparel and sportswear brands where there is a strong brand preference and following amongst their customers. The key is to get the overlap between your brand story and the overarching PSA message right.

- Explore ways to weave your brand story into the ongoing narrative around safety and hygiene

- Use your Brand Heart (purpose, vision, mission, and values) as your North Star to remind yourself what your brand stands for, and how it relates to the current crisis

- Build a community activity around this, fostering a feeling of “we all are in this together”, and hence a large extended family.

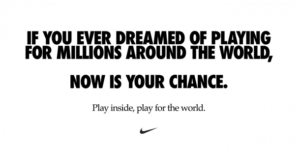

Example : ‘Play Inside’ by Nike

The apparel giant put out a great campaign that encouraged people to ‘play inside’ to comply with the ongoing social-distancing measures enforced by governments. With the campaign, Nike managed to stay true to its inspirational branding while communicating a timely and relevant message. The brand encouraged customers to share home workout and fitness snaps on Twitter and Instagram to maximize brand reach and foster a feeling of community- online challenges are a great way to drive the cohesive mantra.

-

Focus on value-driven content

With the majority of the world’s population being home-bound, digital content consumption is at an all time high during the crisis. This is a great opportunity for brands to build stronger emotional connect with their customers by going beyond the usual transaction-based promotions and communications. Research in behavioural science and consumer behaviour has proven that these non-transactional engagements serve as building blocks for long term brand loyalty.

Campaign Ideas :

These campaigns are heavily context and content-driven so don’t worry too much about getting the technicalities right. A simple video shot on a mobile phone will do the trick if the story and content is engaging. Just be mindful of toning down the sales pitch and instead, focus on delivering helpful content.

- DIY videos and webinars are a great place to start – brands can communicate a range of useful and educational content around upcycling (Fashion & Apparel), repairs (Appliance & Electronics), recipes (QSR & Hypermarkets), beauty tutorials (Cosmetics) etc

- Curate ideas on optimizing WFH schedules, staying fit and other styling advice

- Gaming has also become a viable medium for brands to connect with their customers

- Offer free home trials of products, or leverage immersive technologies like AR to help customers visualise a look once they enter their basic body size parameters like chest, waist etc.

- Serve as a source of trustworthy information and even inspiration amid widespread uncertainties about public health and the pandemic’s economic consequences

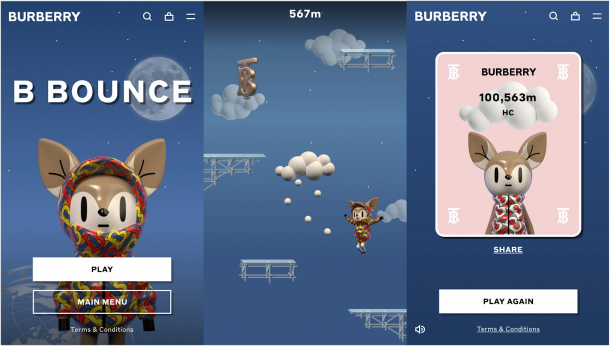

Example : B Bounce by Burberry

Burberry has launched an engaging and playful game in which players race a deer-shaped character to the moon, using supercharged Thomas Burberry monogram puffer jackets. Players compete for special B Bounce prizes, and winners are awarded custom made GIFs and virtual Burberry puffer jackets edited onto a digital picture of their choice. With this campaign, the British fashion house intends to maximize digital share around its latest collection of down jackets.

-

Support a cause and provide an avenue for your consumers to engage with the community

Cause Marketing creates a win-win situation for the brand, the consumer and the charity. Across the world, consumers increasingly expect the companies they buy from to act responsibly and stand up for issues that matter. A survey by Havas found that meaningful brands that take a stand more than double the performance of stock indices on average.

Campaign Ideas :

If your finances permit, consider giving a percentage of each sale to an organization working to fight the Covid-19 crisis. This allows consumers to support the brand they love while also supporting those working to alleviate the impact of the epidemic. Here are some other ways to run a Covid-19 support campaign

- Make donations shoppable – select a charity helping those affected by the virus, then add an option to ‘buy’ the donation in your catalog.

- When customers “purchase” the donation, you can reward them with exclusive loyalty program perks

- Allow customers to use their loyalty points/birthday vouchers to donate to a specific fundraiser with brand matching the donation amount

- If financial contributions are not an option, consider letting out warehouses to host vulnerable sections of the society, or repurposing factories to produce hand sanitisers and face masks.

Example : Feed the Daily Wager by Zomato

Zomato launched the campaign to support the 450 million daily wage workers in India who have lost their livelihoods due to the lockdown. The brand has managed to raise USD 3 Million through donations and has distributed more than 100,000 ration kits. The campaign was widely circulated on various social media by Zomato employees and consumers and raked massive engagement in the digital universe. The Covid-19 clearly showed that customers prefer connecting with brands that go beyond their business model and work towards the larger good of the community. It’s notable to see that Zomato as a brand simply served as a platform for this campaign while all the donations have come from consumers and employees.

Wrapping Up

As you go about using these strategies, it’s important to remember that while business stability might be the primary focus for you, your customers are facing physical, emotional and financial strains during this time. In such troubled times, it is best to over-communicate rather than under-communicate. Much of the problem in the current crisis is uncertainty and the associated anxiety. Try to alleviate it by being in touch with your customers on social media and other communication channels. Send personalized messages to your customers to check in on them and share any uplifting or inspirational news about your brand as and when it happens.

Most of all, stay safe, and please feel free to reach out for anything.