In the first part of this two-part blog series, we touched upon why CPG loyalty is important and what are the latest trends to keep in mind for CMOs while executing brand marketing strategy. In this part, we take a deeper look at the challenges that marketers must address while building a loyalty program.

Imagine a customer walking into a grocery store. Their eye catches colorful packaging embossed with not just brand names but offers and prizes.… In this intense battleground, how is your brand going to stand out in the aisle?

CPG loyalty programs: Challenges faced by marketers

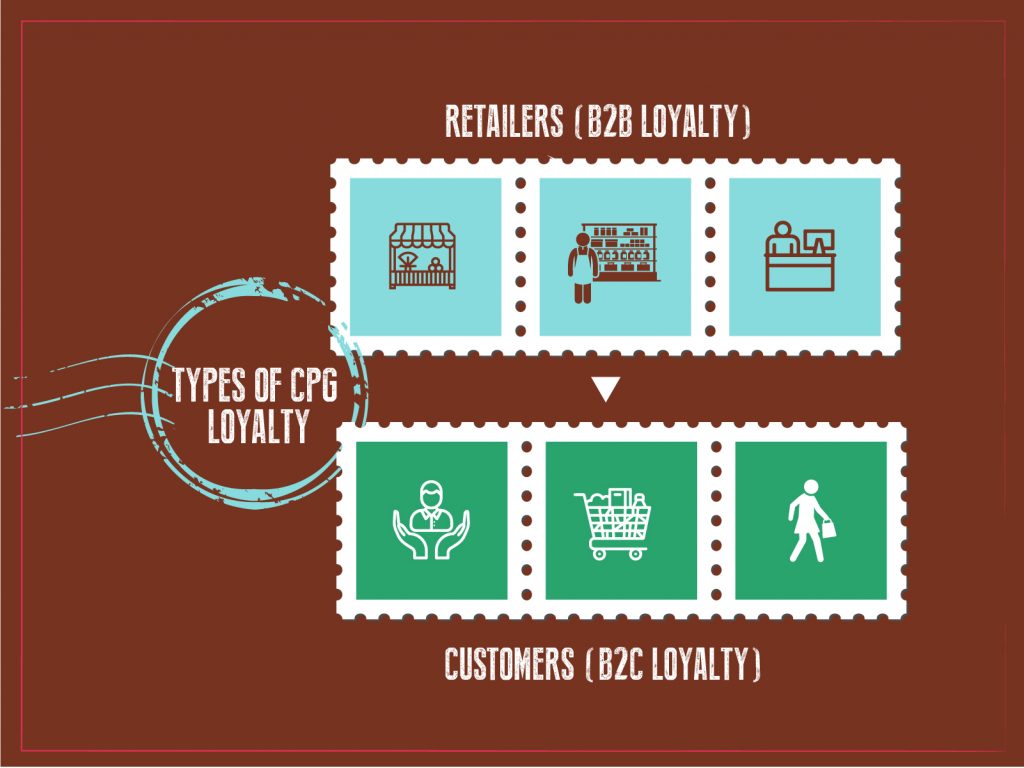

One thing that stands out as the biggest hurdle when implementing loyalty programs for CPG brands is that brands in this sector often lack direct relationship with customers. They are mostly reliant on retail stores for inputs. This dependency leads to several challenges. Some of them are stated as below:

- Limited Customer Database: CPG manufacturers have no physical avenue to capture customer information (transaction data) since it is heavily reliant on the Point of Sales (POS) integration. This creates a vacuum between the brand and the customers and limits customer acquisitions and data capture. Capturing data will go a long way for companies to stay consistently relevant to consumers.

- High Marketing Cost: Consumers are regularly bombarded with ads and billboards on a daily basis. While it’s no cakewalk to come up with catchy content, the engagement through these mass campaigns and advertisements is limited, with no personalization. Generic promotions and offers may not be relevant to every customer, leading to low engagement and redemption.

- Quickly evolving customer preferences: Customer preferences change more rapidly in the CPG space than any other industry. Take the apparel industry, for example – fashion trends change quite frequently in a span of just few months. CPGs are typically low cost items with various competition products available in markets. This contributes to low customer retention with the brand, as customers are inclined to make compromises in their purchases if the preferred products are not available.

- Heavy reliance on retailers: Over the decades, there has been massive seismic shifts in the CPG landscape, in terms of advertising and promotion. While manufacturers wielded this power in the 1980s, the power shifted to the retailers in the 1990s, as they had full access to the POS and scan data. In the current scenario, the power lies in the hands of the customers. The consumers’ choices are heavily driven by social media and information. Therefore, it is important for companies the embrace these shifts and let it drive retail strategies.

- Difficulty in predicting profit: Due to the lack of direct communication between brands and customers, it becomes extremely difficult to measure cumulative customer value over time, to increase the customer loyalty necessary to maximize the Customer Lifetime Value.

- The inevitable competition: While competition exists in all sectors, but it is far more intense when compared with other industries, given that CPGs are fast moving products with the risk of customers switching brands at any moment. It’s challenging for companies to break away from this clutter with brands offering same products and prizes.

CPG loyalty program: How to design an effective CPG loyalty program

- Data is the key ingredient: To stand out in the grocery store and build brand loyalty, data becomes the key pillar for engagement strategies. Today’s consumer is constantly researching, shopping, and engaging with brands online, producing new data sets every minute. CPG brands can collect this data, unify data silos across all such touchpoints using platforms and solutions. The unified data should contain omnichannel consumer interaction, data from supply chain, marketing, and secondary research data, resulting in an all-encompassing view of the touchpoints. This holistic customer data management strategy is a prerequisite to build a valuable loyalty program that maintains dialogue between brand and customers, leveraging customer feedback on products and offering discounts to tailor better engagements. This also sets a platform to share information on product benefits and new product launches, apart from hyper-personalizing messages. Brands can also incentivize customers who share personal information in exchange of rewards and an overall transparency from the company, given that consumers have become increasing intentional about the data they share.

- Digital strategy brings customers closer to brands: CPG brands are now looking to stay relevant with the digital transformation, investing in direct-to-consumer models. Brands must then focus on leveraging digital channels for an optimum loyalty program, and cultivate the desirable behavior of purchasing online. Mobile applications and Microsites serve as the primary interface of interaction between brand and customers, thereby reducing reliance on retailers and trade partners. This creates a win-win situation for both consumers and brands – while consumers experience ease-of-use through digital channels, customer acquisition, data and reward redemption can be easily facilitated for brands.

Several large CPG brands have taken their first steps in this digitized journey. For example, Colgate dove in to a digital-first marketing campaign for their new electric brush that is targeting millennial users. Paired with innovative messaging, this push for ecommerce sales has given the company an edge over competitors, and hopes to deepen its bond with consumers. - Focusing on brand values and ethics: After several months of intense research, Nestle recently launched the vegan KitKat. The company came up with the 100% plant-based alternative to the popular chocolate bar after huge consumer demand. Veganism is just one of the recent trends in the consumer landscape that CPG brands must incorporate in their brands. As we have already seen that 40% of the global consumers are Gen Z, and it has become an important marketing strategy to align products based on their needs. As the newer variants of products get launched, it is paramount to use loyalty programs to boost sales. Consumers can be incentivized to use these new products. Brands can also introduce personalized offers for consumers based on previous purchases and preferences.

- Incorporate Gamification elements– Gamification is especially useful in increasing customer engagement for CPG brands. Brands can apply games like spin the wheel as a way of unlocking rewards, providing incentives to customers to stick to your brand via awarding of badges and stickers. Gamification can boost non-transactional interactions and drive short-term behavior change like product awareness and trials. When Kellogg’s launched Krave, they hoped to direct the marketing at younger consumers. So, the breakfast cereal company made it a point to launch the product in social media channels for the first time. The brand launched a Facebook treasure hunt game that offered daily prizes and giveaways.

Let’s future-proof your brand with agility…

In a recent Harvard Business Review article, Janet Balis (Partner at EY Consulting) writes 10 sharp marketing truths that emerged after the pandemic. While many of them reiterates the importance of customer-centricity, one of the pointers discusses about how agility has become a marketing approach rather than a technology process. In terms of building CPG loyalty, this requirement to implement agile marketing strategies is an advantage.