Almost six months into the global coronavirus pandemic and retailers across the globe continue to be severely impacted. Even countries that are no longer under lockdown orders are still witnessing a steep drop in footfall in retail outlets. In a recent webinar organised by Trust for Retailers & Retail Associates of India (TRRAIN), major associations anticipated a 25-30% impact on business, with a multiplier effect on subsidiary industries and lasting job losses. Since the outbreak of COVID-19, retailers are facing challenges around health & safety, supply chain management, labour shortages, consumer demands, disruption in cash flow, and pricing.

Interestingly, the overwhelming opinion from research firms is that global consumer behaviour will evolve due to the coronavirus for the foreseeable future. One reason for this is that new mindsets and habits are being created as life goes on in lockdown-induced quarantine. And for many consumers, the continued fear and apprehension for their health and safety will push them to find innovative new ways to make purchases and create a ‘new normal’.

While consumer demand continues to be volatile, new commerce trends are emerging in countries reporting a slow uptick in the economy; trends like store reopenings with increased social distancing measures, increase in online grocery shopping, social commerce (according to emarketer.com, up to 51% of U.S. adults have been using social media more), live-streaming commerce (most prominently in China and Southeast Asian markets), and other trends. Although it would be difficult for businesses to make accurate long-term strategic decisions during this volatile period, it is imperative for CXOs to revisit current business and operating models in the face of the new normal.

We believe the businesses who emerge as leaders from this crisis will be businesses that adapt swiftly. Capillary has been analysing the impact of Covid-19 on retailers across the globe and evolving our solutions to help retailers quicken their pace towards recovery.

Taking your store to your best customers: Introducing Store2Door+

Although online commerce has been on an upward trend in the last decade, the coronavirus pandemic has accelerated the growth of ecommerce like never before. This change can be witnessed across all demographics; even the senior citizen demographic has demonstrated a 195% increase in ecommerce activity from January to March, and there has been a spike of more than 130% in online shopping across all demographics. Consumers are buying products online and picking them up in stores at +500% greater volume than prior to the pandemic, according to research from Kibo Commerce.

However, this leaves us with a big question: are traditional retailers doomed to end up last in the post-COVID-19 world?

We don’t think so; rather this is an incredible opportunity for traditional retailers to pivot to an omnichannel retail strategy. Based on our conversations with traditional retailers in SEA, China & the Middle East, the major resistance to ecommerce adoption centred around initial investment costs, lack of in-house tech experts, implementation timelines and ROI. That’s why we set out to launch Store2Door+– a new module in our Anywhere Commerce suite that: has minimal setup cost, requires zero in-house tech expertise or coding, can go live in less than 7 days and ensures highest ROI through an outcome-linked pricing model.

Here’s how Store2Door+ helps traditional retailers adapt swiftly to the new normal :

- Leverage existing CRM data to personally connect with customers through Whatsapp Business, and empower store staff to close sales over Whatsapp. With Store2Door+, retailers can take their business online in just 7 days.

- Store2Door+ allows sending personal recommendations and communication to customers through Whatsapp messaging, a platform that boasts of high message open rates (over 90%). Store2Door+ helps retailers drive greater store sales, especially in disruptive times when customers are apprehensive about visiting stores

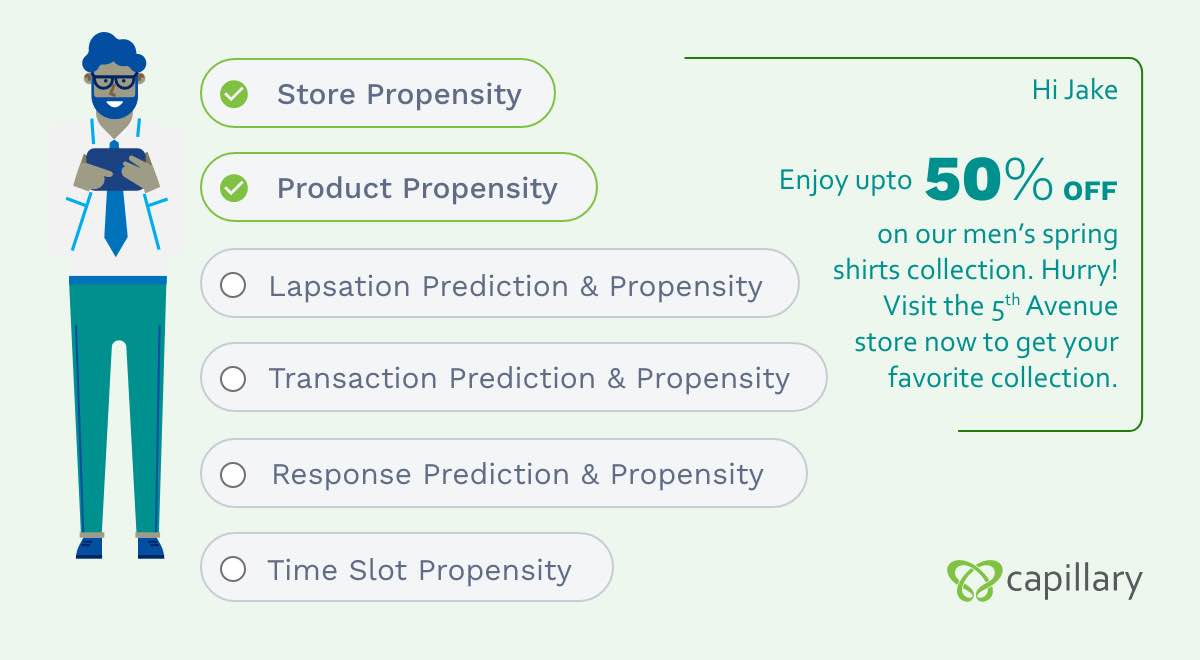

- Targeting the right customers: With the Store2Door+ app, store staff can view a list of customers who are most likely to respond to a particular product recommendation based on their past purchasing history and other CRM data

- Assisted shopping experience: By creating a personal connection, and sending customized recommendations and real-time videos, the store stylists provide a very compelling shopping experience for their customers (far better than the online shopping with chatbot assistance)

- Connecting remotely: Store2Door+ allows store staff to sell products to their best customers 1:1 over WhatsApp business, and keep in touch with loyal customers even remotely.

- Streamline communication: For multi-store retailers that already have marketplace or ecommerce presence, or for retailers who want to drive store sales separate from regular ecommerce, Store2Door+ can enable a streamlined flow for sending daily communications to the top customers

- Leverage existing resources: Store2Door+ integrates CRM data and leverages your existing loyalty member base to drive sales, and reducing customer acquisition costs. Leverage offline stores as fulfilment centers, and fulfil orders from the nearest store with a minimal delivery timeline.

Based on results from pilot programs, Store2Door+ contributed 19% of loyalty sales in best performing stores, and 5% on average in remaining stores.

Driving greater conversions through contactless interactions

With the rampant rise of Covid-19 cases globally, consumers are plagued by fear of infection. Since physical experiences are no longer possible, ‘no-touch’ or contactless interactions have become the new standard expectation. Various retail leaders are adapting by creating contactless transaction processes. For example, Walmart is testing a store without any cashiers or conveyer belts at checkout lines, with the intent of speeding up checkout times and preventing the spread of coronavirus by limiting human interaction.

Here are some recommendations from Capillary to improve in-store safety, and increase customer confidence:

- Brands must improve in-store purchase experiences during the pandemic through contactless payment, digitizing receipts, as well as digitizing personalized promotions. Retailers can do this via an app, SMS, email, QR codes for payment, and other options.

- When customers visit stores, retailers should cross-sell, up-sell, and drive greater conversions with real-time, rule-based dynamic vouchers. The dynamic voucher must be digitally rolled out to customers upon an in-store purchase, based on the loyalty-tier of the customer, product purchased, or other factors like churn probability, Customer Lifetime Value (CLV) etc.

Optimizing Costs with Targeted Promotions

Companies today are facing major cash-flow shortages. It becomes imperative for brands to strike the right balance in spends across the marketing, sales and service functions, in order to maintain the right customer experience. Although customer engagement, marketing and support become more difficult during economic downturns and turbulent times, they become all the more important to drive strong customer experience, trust, and more revenue in the long-run. In a recent analysis of retail and online brands, Digital Commerce 360 found that brands that pulled back on marketing spend during COVID-19 are now seeing their online sales struggle. Similarly, according to KPMG, it’s even more vital during these unprecedented circumstances for companies to have a single view of the customer, shared by the Marketing, Sales and Service functions, so they can react quickly to their fast-changing needs and expectations.

Capillary’s solutions allow brands to do that and more:

- Channel-based promotions: Omnichannel marketing and engagement can improve noise to signal ratio for customers, especially in times where they are being bombarded by communication and promotions from multiple brands. The key is to optimize your costs by targeting customers on only their favourite channel of communication to improve response rates. For instance, a user might have higher response rates to Instagram ads when compared to Facebook, and this behaviour might change based on whether he’s on a mobile device or a desktop. X-Engage lets you control communications and engagement based on these specific criteria and conditions.

- Capping discount amount: Capillary’s Anywhere Commerce platform now allows brands to create promotions specifically for discounted or undiscounted products, and even cap the Percentage Discount Amount on the product.

- Focus on your “Top X%” customers: Although the personalization fabric is typically woven with months or years of customer data, the new normal has shifted customer behaviour and user preferences beyond anyone’s imagination. To avoid irrelevant recommendations and wasteful spends, a key method is to use smart segmentation to focus on your “Top X%” customers and have a dynamic campaign based on real-time user behaviour.

- Wishlist communication: The pandemic has resulted in retailers facing challenges around stock shortages. On the other hand, lockdown relaxation is seeing a release in the pent up demand around non-essential goods. Capitalize on this trend by triggering wishlist notifications for items when they’re back in stock based on real-time inventory levels of the product.

- Optimizing order allocation: The ability to predict and manage demand has never been more important. With smart order allocation, optimize costs by allocating orders based on the store nearest to customers, or improve the customer’s experience by directing them to promotion-specific stores

In these turbulent times, business leaders should align their financial sustainability with the core elements of operational excellence and customer experience. Brands that can pivot and seamlessly adapt their customer experience in these times of crises will certainly come out stronger.