Malaysia’s ecommerce market is quickly becoming one of the largest in Southeast Asia. Its growth is outpacing that of traditional established markets in the region. This was apparent even before the impacts of the pandemic— Malaysia’s business-to-consumer e-commerce value increased 39 percent in 2019 alone. This growth in ecommerce has been coupled with the growing consumer preference for online shopping, and availability of customized payment options in recent years.

Malaysia’s tryst with Ecommerce started in 2004 with the launch of eBay Malaysia. This was followed by Lelong.com.my in 2007 – a C2C platform – that attracts more than 9.56 million visitors per month. The current state of Malaysian ecommerce market started taking shape In 2012 when two major players Lazada and Zalora launched their Malaysian operations, followed by Shopee in 2015. Fast forward to 2020, Malaysia’s eCommerce market is worth US$ 4.3 billion, and is expected to double to $8.1 billion by the year 2024; at 14% CAGR. Malaysia is now catching up to bring its e-commerce infrastructure, including product availability, payments, delivery and regulatory requirements, in line with more established online shopping markets.

Factors Spurring E Commerce Growth in Malaysia

At 82.3%, Malaysia has one of the highest internet penetration rates in south-east Asia. Ecommerce growth in Malaysia is primarily driven by a growing number of digitally-savvy, middle-class people who are looking for great deals and access to international brands. Here are the other major factors driving ecommerce growth in the region.

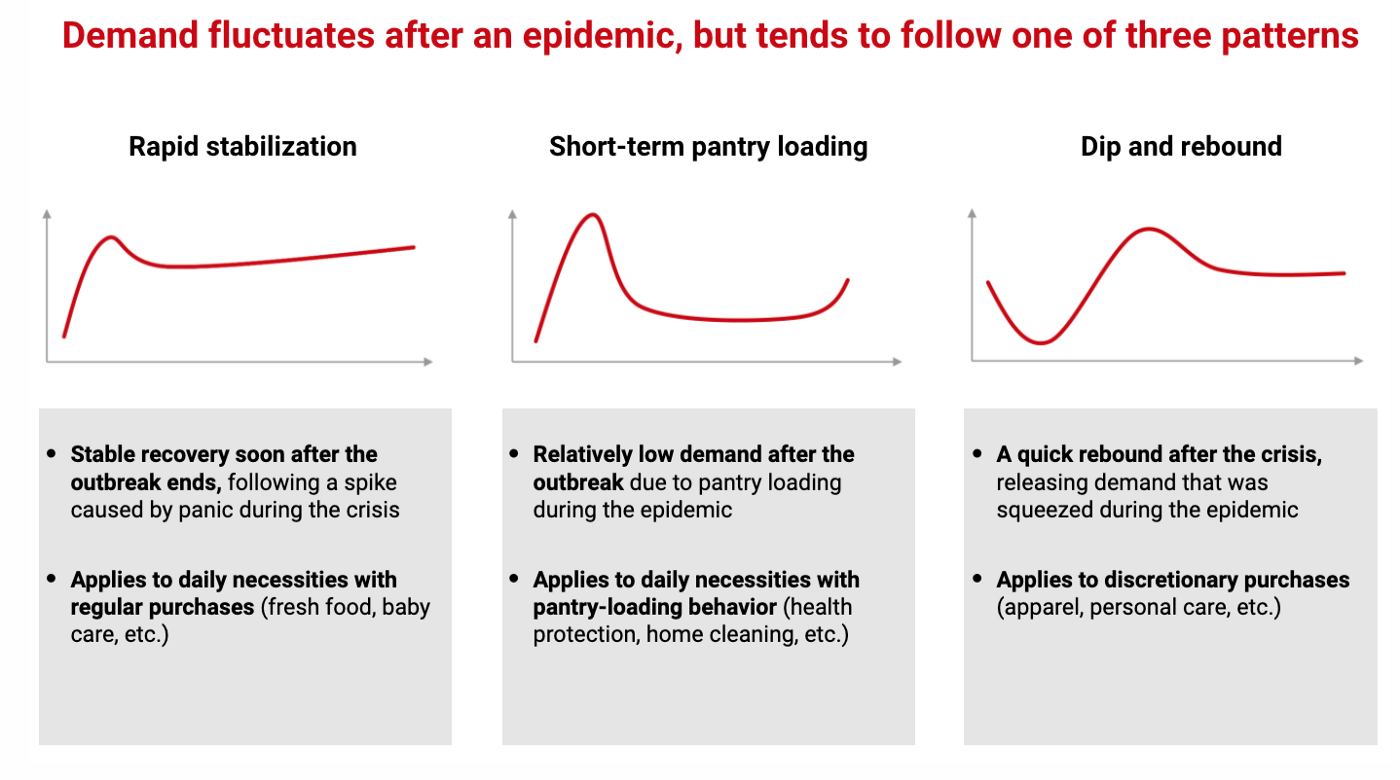

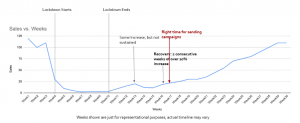

- Social Distancing and COVID-19 Restrictions: According to the Malaysian Communications and Multimedia Commission (MCMC), during the current pandemic internet traffic has increased by 30-70%. However, what is most encouraging is the Malaysian government recognizing this rise in ecommerce as a tool of inclusiveness, and has announced support for empowering local micro, small, and medium enterprises (MSMEs). This is predicted to further drive ecommerce in Malaysia. The Malaysian government has been proactive with these concerns through digital campaigns like “Buy Malaysia” and #SayaDigital to encourage local demand and empower Malaysians to surge the country towards a digital transition.

- Seamless Delivery Logistics: Traditionally ecommerce players in Southeast Asia faced logistical challenges due to the fragmented topology of the region dominated by multiple islands and dense jungles. However, Malaysia is segregated into only two major parts – Peninsular Malaysia and East Malaysia; which makes ecommerce logistics a whole lot more straightforward and cost-effective.

- Surge in Online Grocery Shopping: Similar to other countries in Southeast Asia, grocery & FMCG ecommerce is rapidly growing in Malaysia. In fact, Malaysia ranked 2nd in Statista’s world’s fastest growing grocery market list in 2018, with only Singapore registering a higher YoY increase. IGD Asia predicts that online sales value of grocery in Malaysia will increase at a CAGR of more than 60 percent between 2017 and 2022 (https://asia.igd.com/Portals/4/Asia-online-forecasts-free-download.pdf).

- Digitally-savvy consumers: Malaysia boasts of an incredible 140% mobile penetration and 85% internet penetration. More than 26 million Malaysians access the internet and 80% of users between the ages of 16 and 64 are already shopping online. Malaysia’s mobile commerce growth is outpacing overall e-commerce, projected to rise at a compound annual growth rate of 19.7 percent to 2023, to become a US$8.9 billion market.

- The Rise in Social Media: The lines between social media and ecommerce are increasingly blurring, thanks to several native shopping initiatives by Facebook & Instagram. Besides, social media serves as a great discovery and post-purchase platform for ecommerce businesses. As of 2019, Malaysia had 25 million active social media users which accounts for 78% of the total population. This digitally-savvy, upwardly mobile segment presents a massive potential customer base for ecommerce businesses.

- Preference for Digital Payments: Bank transfers dominate as the primary e-commerce payment method in Malaysia, accounting for 44 percent of all transactions. Consumers in emerging ecommerce markets typically steer clear of digital payments and tend to rely heavily on Cash on Delivery. This has been a roadblock to ecommerce growth in several regions like India, Brazil, Saudi Arabia etc, since COD imposes scalability challenges on ecommerce businesses. Malaysia is an outlier here with bank transfer and digital payments accounting for a whopping93% ecommerce transactions and there are currently 39 businesses with an e-money license in the country, including major players PayPal, Alipay, WeChat and Google Pay.

- Government Assistance: The positive growth of the ecommerce industry in Malaysia will also be driven by the government’s National E-commerce Strategic Roadmap initiatives that strive to increase internet accessibility to rural areas and improve e-wallets technologies.

Key Ecommerce and Consumer Trends in Malaysia

The Malaysian ecommerce space shares a lot of similarities with other emerging markets in SEA like Singapore, Indonesia & Thailand. However, there are some interesting cultural and region-specific nuances to watch out for.

- Transactions Across Borders: Cross-border spending is high in Malaysia and accounts for 4 out of 10 of all e-commerce transactions in the country. The major motivators for Malaysians to choose international sellers brands are: better prices (72%), and access to items not available in the country (49%). The top three countries for cross-border sales are China (first), Singapore (second) and Japan (third). However, it should be noted that the Malaysian government has plans to announce a digital tax for cross-border e-commerce from 2020, which could impact international sellers of digital products.

- Mobile-First Audience: Consumers in Malaysia have been quick to adapt to mobile commerce and 80% of smartphone users now use their devices to shop online. Mobile ecommerce transactions in the region are expected to reach $5.6 billion by 2021. Within the mobile category, apps are the most preferred ecommerce channel and used for 64 percent of transactions.

- Affinity towards discounts: A report by Paypal found that Malaysians prefer online shopping primarily to save time and 90% of Malaysians expect their purchase to be delivered within a week. The second biggest factor that attracts consumers to shop online are cheaper prices. This could likely be driven by a rising middle class who faces comparatively high taxes and stagnating wages. This also explains why ecommerce events in Malaysia like 11.11 and 12.12 that offer higher discounts (as high as 90%) drive the highest sales in the Home & Living, Fashion, Health & Beauty, Accessories, and Mother & Baby categories.

- Ease of Digital Payments: Across Malaysia, bank transfer and digital wallets are the most preferred payment method. Interestingly, credit cards are the most preferred payment method in Penang (28%), Perlis (40%), Selangor (25%) and WP Kuala Lumpur (34%). Digital wallets, known as dompet digital in Malaysia, are the fourth most-used payment option. However, their usage is expected to grow at a CAGR of 53% by 2021, at which point it will take a 16% share of the Malaysian payments market. On the other hand, it is still advisable to offer cash on delivery (COD) as a payment method since the 45-54-year-old age group still prefers COD when shopping online.

- Social Commerce: The rise in usage of smartphones has also led to a spike in social media commerce, especially through WhatsApp and Facebook. The country is said to be the world’s fourth-largest market for social commerce adopters and a recent survey found that 87 percent of survey respondents had bought something through apps like Facebook, Facebook Messenger or Whatsapp.

- Competition Between Regional & International Retailers: The Malaysian branches of two online shopping platforms based in Singapore – Lazada and Shoppee are the leading websites in shopping traffic and both have close to 20 million visitors per month. Even as these two leaders expand their product offerings and services, other regional players, such as Indonesia’s Bukalapak and Chinese players such as Taobao and Ali Express are increasing their presence on the peninsula.

- Annual Shopping Events: Malaysians shop online in preparation for major holidays, especially Chinese New Year and Ramadan. They visit multiple ecommerce platforms weeks ahead of these celebrations to compare products and prices. Shoppers look for gifts to give to their family and friends on Chinese New Year, as well as beauty and fashion products for self-care. Besides this, Malaysia has three major annual national shopping events—Malaysia Super Sale (March 1–31), Malaysia Mega Sale Carnival (June 15–August 31) and Malaysia Year-End Sale (November 1–December 31). International discount shopping events Singles’ Day and Black Friday in November are also rising in popularity.

Malaysia’s Ecommerce Space

Malaysia’s top-three e-commerce sites by traffic are marketplaces Shopee, Lazada and PG Mall. The ecommerce space in Malaysia is dominated by self-owned, branded e-commerce websites and big online marketplaces. Here are the top ones :

How to Strategize Your Brand For Malaysian Ecommerce

Given its population size and increasingly affluent middle class, Malaysia is easily one of the most attractive markets for ecommerce in Southeast Asia. Here are some strategies that retailers and brands can use to leverage this opportunity.

- Offer a diverse product range – Concerns around product diversity have been a constant challenge for Malaysian consumers, and online sellers have the opportunity to satisfy this unmet need. The key to getting the right mix of products is to use AI-powered ecommerce platforms to understand the top products and accessories for each customer segment and dynamically personalize product pages for specific segments.

- Provide a wide range of payment options – While bank transfers are the most preferred payment option, retailers should also include e-wallets, credit cards, and COD to serve the wider audience. Merchants should reassure customers that they have all the resources to avoid problems like outdated payment methods, unreliable delivery and incidences of fraud.

- Offer superior fulfilment experience – 90% of Malaysians expect their online purchases to be delivered within a week. Allow customers to track deliveries in real-time, so they don’t have to guess the delivery dates. The key to offering a great shipping experience is to have a centralized inventory across your stores, warehouses and other fulfilment centres.

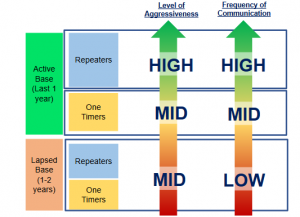

- Understand local nuances – There are certain cultural nuances that are specific to Malaysia. It’s important to know what Malaysians like to buy, and when. Understand the customs, traditions, and holidays that influence their shopping behaviour, and increase conversions by personalizing marketing engagement and conversions with customers using the power of customer segmentation.

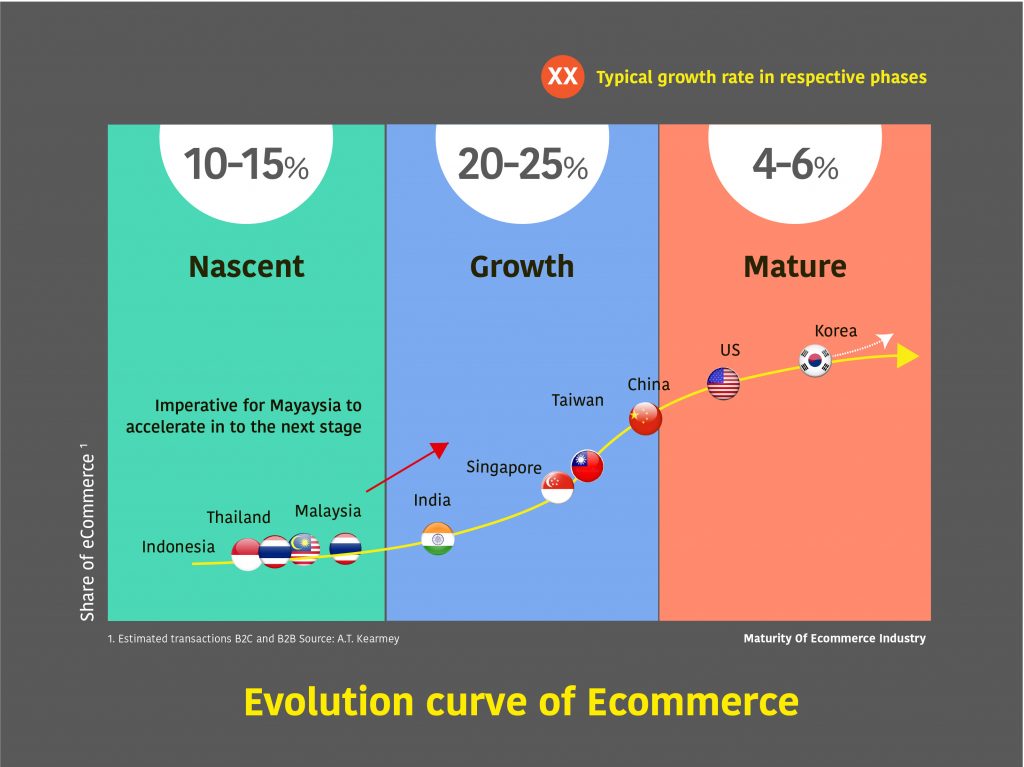

While the ecommerce market in Malaysia is nascent compared to mature markets like China and Japan, it still represents one of the largest ecommerce markets in SEA. Malaysia stands out due to its relative size in the cross-border share of the ecommerce market. Malaysia’s youth population highlights the economy’s future potential as an e-commerce market. Malaysian consumers are often looking for great deals and access to international brands, but these trends may shift away if more local brands prioritize delivering superior customer experiences, products and prices than rival international brands.